In the release overview of the Sage 100 ERP 2013 Initial Pre-Release Guide, you’ll learn that “The Sage 100 ERP 2013 release (formerly Sage ERP MAS 90 and 200 5.0) will focus on providing compelling value to existing customers, generate interest in the marketplace with new connected services and add-on solutions, and continuing to offer more deployment and pricing options. Substantial value will be provided to existing customers by addressing their top enhancement requests, Auto Updates for easy application of Sage 100 ERP Product Updates, enhanced Credit Card Processing using Sage Exchange, and more.” This blog sneak peek will focus on the credit card processing enhancements coming in Sage 100 ERP 2013.

Credit Card Processing in Sage 100 ERP 2013 will utilize Sage Exchange to provide many enhancements and increased flexibility including card-swipe capabilities, charges for repetitive invoices and Accounts Receivable invoices, mobile payments, improved cash flow management and forecasting, and will provide a consolidated view of payment activity.

What is Sage Exchange?

Sage Exchange is the cloud-based technology developed by Sage Payment Solutions that provides the integration between Sage 100 ERP and the Sage Payments Gateway. It consists of three key elements, the Sage Exchange Vault, the Sage Exchange Portal, and third party developer tools which enable Sage Development Partners to connect to Sage Exchange. The Sage Exchange technology includes connection to a secure vault for storing all sensitive credit card information outside of Sage 100 ERP, as well as for processing credit card transactions.

What is the Sage Exchange Portal?

The Sage Exchange portal provides a user-configurable dashboard and flexibility to view payments information on the web via a tablet or desktop. Customize My Dashboard to gain access to the payments information you want to see. Assign access to the Sage Exchange portal for your employees, and easily establish connections to link employee’s tablets and mobile phones to Sage Exchange. Plus have 24/7 access to the Sage Payment Solutions customer support database right at your fingertips.

Why is the Sage Exchange Vault important?

The cloud-based vault helps to reduce fraud exposure by storing all sensitive cardholder data there rather than in Sage 100 ERP data tables. For added cardholder security, Sage 100 ERP 2013 will also allow a one-time use credit card for a payment transaction without saving credit card information. Customers migrating from previous versions of the software will be able to easily move their customers’ credit card information from their current location into the secure Sage Exchange Vault. The process will be streamlined for customers who are already using Sage Payment Solutions, so if you are using another processor now, it is highly recommended that you consider switching before you upgrade to Sage 100 ERP 2013.

How will card swipes be integrated in Sage 100 ERP 2013?

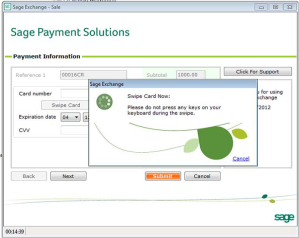

Sage Exchange will reduce merchant transaction fees when cards are present and speed the data entry process when swiping credit cards using a Sage Payments recognized USB card swipe device attached to the terminal. Our new card swipe capabilities have been truly integrated so that payments processing is built into the normal Sage 100 ERP workflow, which can replace the disconnected card swipe capabilities many companies use. So, for example, when processing an order within Sage 100 ERP, after all line items are entered in the order and the clerk proceeds to the payments tab, after indicating that the payment method will be credit card, the Sage Exchange window pops up to allow the customer’s credit card to be swiped directly into Sage Exchange. But if the card isn’t present and the card number is already stored in the vault, the same workflow will allow selection of the correct customer’s card for retrieval from the vault. And if the order is being entered while the customer is on the phone, a card can be entered for one time use using the same workflow. It’s all been streamlined to be simple and fast.

How Will Sage Mobile Payments be Integrated with Sage 100 ERP 2013?

Sage Exchange will allow payments to be collected anytime, anywhere, via smart phone. Ideal for cash sales, Sage Mobile Payments will immediately capture the cash transaction information for a sale and send it to Sage Exchange, for secure transfer to Sage 100 ERP 2013 Accounts Receivable Cash Receipts Entry. A cash receipt batch will automatically be created for these mobile cash transactions which can be updated by accounts receivable personnel at the end of each day. Companies that provide services and collect fees in a mobile environment, such as mobile pet grooming, will find this functionality especially helpful.

What other functionality will be available from Sage Mobile Payments?

Sage Mobile Invoice Query, Pay and Post will be introduced in a Product Update shortly after the release of Sage 100 ERP 2013. This functionality will benefit companies with a mobile sales force that also collects payments on outstanding invoices. The software will include the ability to identify an existing Sage 100 ERP customer from the mobile device, view the customer’s open invoices, and select one of the open invoices to pay. With a Sage Mobile card swipe device connected to the smartphone, the salesperson can swipe the customer’s credit card and present the touch screen of the mobile device to the customer for signature approval of the charges. The credit card receipt can optionally be emailed directly to the customer from Sage Exchange. And, not only will the payment go directly into the merchant’s bank account just like any other credit card transaction, but it will also create a cash receipts batch within Sage 100 ERP to complete the financial transaction.

What is happening with the PCCharge Payment Server Integration to Sage 100 ERP?

PCCharge Payment Server will no longer be integrated with Sage 100 ERP 2013. The way in which PCCharge was integrated with previous versions of Sage 100 ERP required Sage 100 ERP software to store credit card numbers. As detailed above, with version 2013, credit card numbers will no longer be stored within the ERP software, therefore PCCharge will not work. Also, Sage’s customer support department will answer questions about the ERP side of PCCharge for older versions of Sage 100 ERP through December 31, 2012. As of that time, Sage 100 ERP support for PCCharge will end.

On to the adventure,

Czarina Erika

Pingback: 3 Tips For Saving Money On Your Sage Payments Account - Sage 100 ERP Consulting (FKA Sage ERP MAS90 and 200)